When it comes to investing in stocks, one of the most commonly used financial ratios is the Price-to-Earnings (P/E) ratio. The P/E ratio is a valuable tool for investors as it provides insights into a company’s valuation and its potential for future growth. In this article, we will explore the significance of the P/E ratio and how to interpret it.

What is the P/E Ratio?

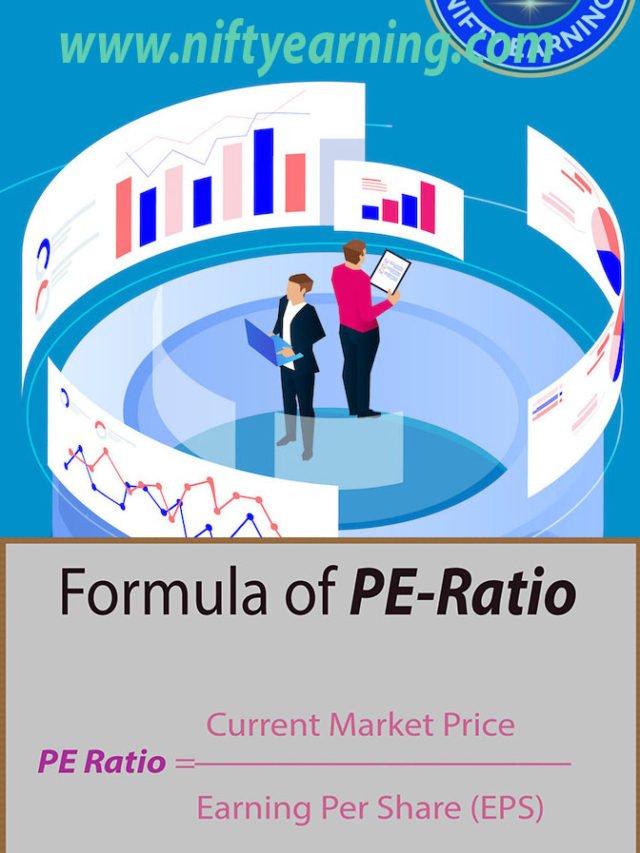

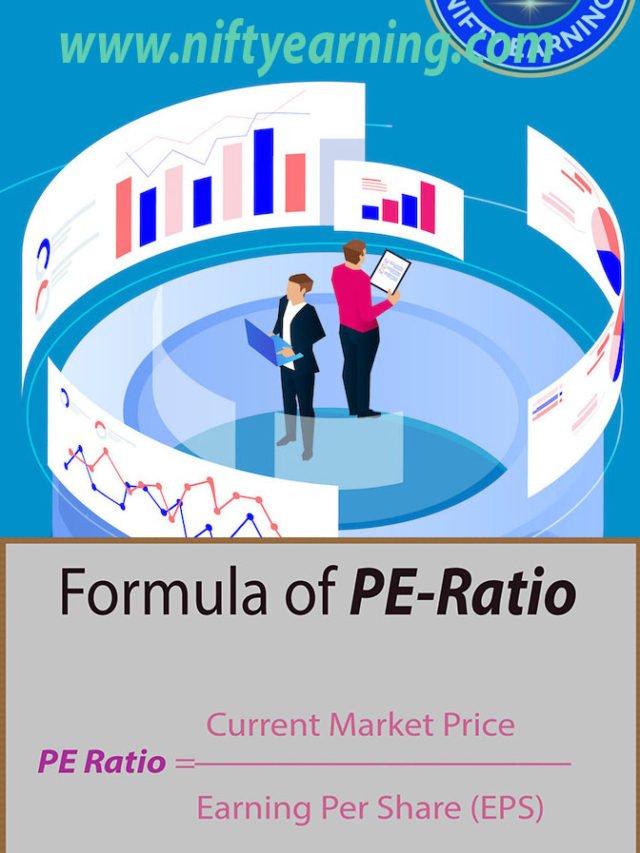

The P/E ratio is a simple calculation that compares a company’s stock price to its earnings per share (EPS). It is calculated by dividing the market price per share by the earnings per share. The formula for calculating the P/E ratio is as follows:

P/E Ratio = Market Price per Share / Earnings per Share

For example, if a company’s stock is trading at $50 per share and its earnings per share is $5, the P/E ratio would be 10 ($50 / $5).

The Significance of the P/E Ratio

The P/E ratio provides investors with a snapshot of how much they are willing to pay for each dollar of earnings generated by the company. A high P/E ratio suggests that investors have high expectations for the company’s future growth and are willing to pay a premium for its stock. On the other hand, a low P/E ratio may indicate that investors have lower expectations for the company’s growth prospects.

The P/E ratio is also useful for comparing companies within the same industry. By comparing the P/E ratios of different companies, investors can identify which companies are overvalued or undervalued relative to their peers. However, it’s important to note that the P/E ratio should not be the sole factor in making investment decisions. Other factors, such as the company’s financial health, industry trends, and competitive landscape, should also be considered.

Interpreting the P/E Ratio

Interpreting the P/E ratio requires a deeper understanding of the industry and the company’s growth prospects. A high P/E ratio may indicate that the company is expected to experience significant growth in the future. However, it could also mean that the stock is overvalued and may be due for a correction. Conversely, a low P/E ratio may suggest that the company is undervalued, but it could also indicate that the market has low expectations for its future growth.

It’s important to consider the P/E ratio in relation to other factors such as the company’s historical P/E ratio, the industry average, and the overall market conditions. A company with a high P/E ratio may be justified if it has a strong track record of consistent growth and a competitive advantage in its industry. Similarly, a company with a low P/E ratio may present a buying opportunity if it has solid fundamentals and positive growth prospects.

Limitations of the P/E Ratio

While the P/E ratio is a useful tool for investors, it does have its limitations. The P/E ratio does not take into account factors such as the company’s debt levels, cash flow, or future growth potential. Additionally, the P/E ratio can be influenced by market sentiment and investor expectations, which can result in inflated or deflated valuations.

Furthermore, the P/E ratio may not be suitable for comparing companies in different industries, as different industries have varying growth rates and risk profiles. It’s important to use the P/E ratio in conjunction with other financial ratios and qualitative analysis to gain a comprehensive understanding of a company’s valuation and investment potential.

In Conclusion

The P/E ratio is a significant financial ratio that provides investors with insights into a company’s valuation and growth prospects. However, it should not be the sole factor in making investment decisions. Investors should consider other factors such as the company’s financial health, industry trends, and market conditions to make informed investment choices. By understanding the significance and interpretation of the P/E ratio, investors can make more informed decisions and navigate the stock market with confidence.