1. Introduction to the Nifty PE Ratio

The Nifty PE Ratio, a crucial metric in the world of stock market analysis, plays a pivotal role in helping investors make informed decisions. Understanding this indicator is essential for anyone looking to navigate the complex landscape of financial markets.

Table of Contents

2. What is PE Ratio: Definition and Meaning

The PE ratio, or Price-to-Earnings ratio, is a valuation metric that measures the relationship between a company’s stock price and its earnings per share (EPS). It is calculated by dividing the current market price of a stock by its EPS.

2.1 Calculating PE Ratio

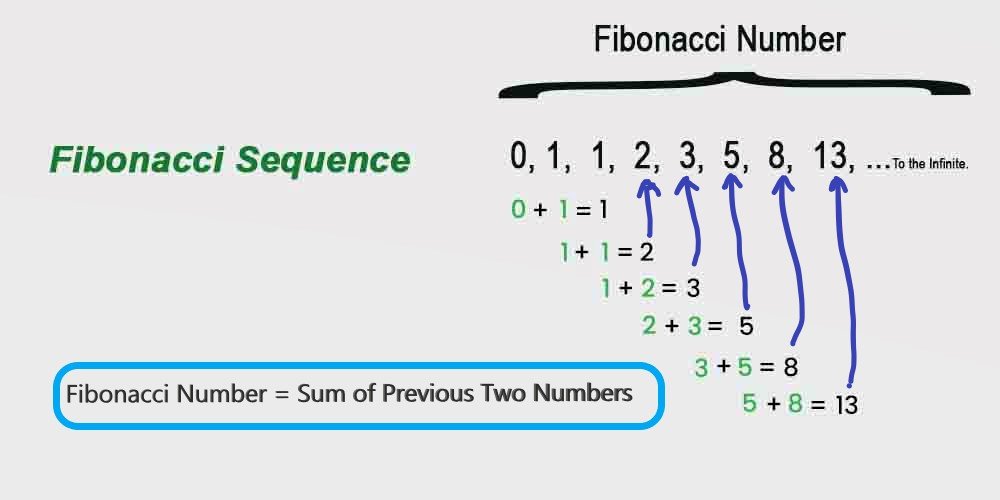

The Price-to-Earnings (P/E) ratio is calculated by dividing the market price per share of a company by its earnings per share (EPS). Here is the formula:

PE Ratio = Market Price per Share / Earnings per Share

To calculate the P/E ratio, you need to know the market price per share and the earnings per share of the company.

2.2 Interpreting PE Ratio

A high PE ratio suggests that investors are expecting higher future earnings growth, while a low PE ratio may indicate that the market has a bearish outlook on the stock.

3. Importance of NSE PE Ratio

The NSE PE Ratio, specific to the National Stock Exchange, provides valuable insights into the overall market sentiment and can be a crucial tool in assessing the valuation of stocks listed on the exchange.

4. Historical Trends and Analysis

4.1 Bull Markets and PE Ratios

During bull markets, PE ratios tend to be higher as investors exhibit confidence in the economy’s growth prospects.

4.2 Bear Markets and PE Ratios

Conversely, in bear markets, PE ratios often decrease as investors become more cautious and risk-averse.

5. Factors Affecting PE Ratio

5.1 Industry Influence

Different industries have varying average PE ratios due to variations in growth rates, risk, and market conditions.

5.2 Economic Conditions

Economic factors, such as inflation and interest rates, can significantly impact PE ratios.

5.3 Company-specific Factors

The financial health and performance of a specific company play a crucial role in determining its PE ratio.

6. Comparing PE Ratios

Comparing the PE ratios of different companies within the same industry can offer valuable insights into their relative valuations.

7. Limitations of PE Ratio

While PE ratios are a valuable tool, they have their limitations and should be used in conjunction with other metrics for a comprehensive analysis.

8. Using PE Ratio in Investment Strategies

Integrating PE ratios into investment strategies can help investors identify undervalued or overvalued stocks.

9. Case Studies: Successful Application of PE Ratio

Examining real-world examples of how PE ratios influenced investment decisions can provide valuable lessons for investors.

10. Common Misconceptions about PE Ratio

Addressing and dispelling common misconceptions about PE ratios can help investors make more informed decisions.

11. Expert Advice on Nifty PE Ratio

Gaining insights from financial experts on how to effectively utilize Nifty PE ratios in investment strategies.

12. Future Trends and Forecasts

Anticipating how changes in market dynamics and economic conditions may impact PE ratios in the future.

13. How to Stay Updated on NSE PE Ratios

Staying informed about the latest NSE PE ratios and market trends is crucial for making timely and informed investment decisions.

14. Conclusion: Harnessing the Power of PE Ratios for Informed Investing

The Nifty PE Ratio, also known as the Price-to-Earnings Ratio, is a critical financial metric used in stock market analysis. It provides valuable insights into the valuation of companies listed on the National Stock Exchange (NSE) of India.

The formula for calculating the PE ratio is straightforward: it is derived by dividing the current market price of a stock by its earnings per share (EPS). Mathematically, it can be expressed as:

PE Ratio = Current Market Price / Earnings Per Share (EPS)

The PE ratio essentially represents how much investors are willing to pay for each unit of earnings generated by a company’s stock. A higher PE ratio suggests that investors have higher expectations for future earnings growth, while a lower PE ratio may indicate a more conservative market outlook.

Understanding and analyzing the Nifty PE Ratio is crucial for investors seeking to make informed decisions in the dynamic world of stock trading and investment. It provides a valuable tool for assessing the relative value of stocks and plays a significant role in shaping investment strategies.