Mastering Scalping Trading Strategy 2024:

Introduction

In the fast-paced world of trading, mastering strategies that capitalize on swift market movements is essential. One such strategy gaining popularity is scalping. This article delves into the intricacies of scalping trading strategy, who a scalper is, and the meaning of scalping in trading. Read on to gain insights into this dynamic trading approach.

Table of Contents

Understanding Scalping Trading Strategy

Scalping is an intraday trading strategy characterized by the execution of numerous small trades within a short timeframe. Scalpers aim to profit from the often minuscule price fluctuations that occur throughout the trading day. This strategy requires keen market observation, quick decision-making, and precise execution.

Who is a Scalper?

A scalper is a trader who specializes in executing scalping strategies. These individuals thrive in fast-paced market environments and possess exceptional analytical skills. A successful scalper must have a deep understanding of market dynamics, technical indicators, and a disciplined approach to risk management.

Meaning of Scalping in Trading:

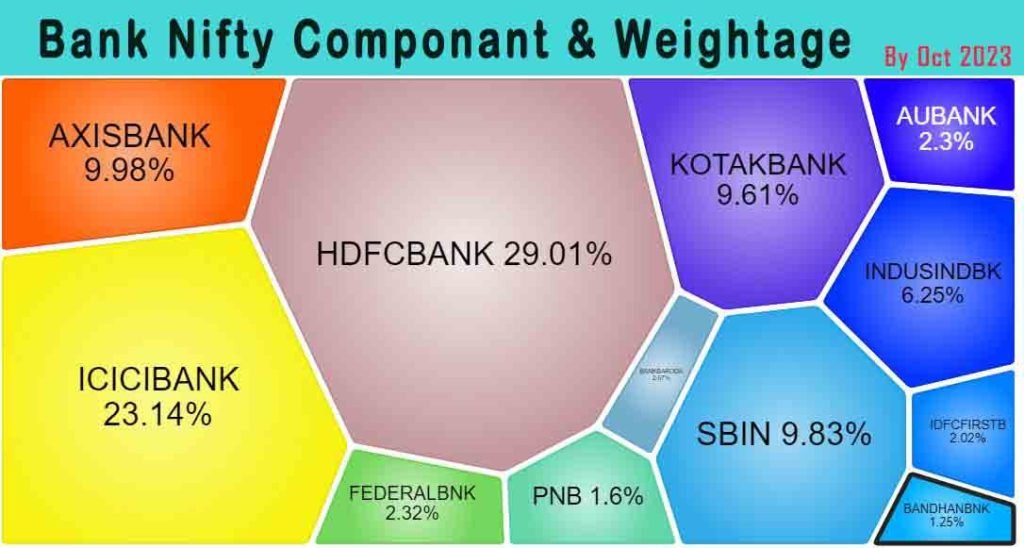

Scalping, in the context of trading, revolves around the rapid buying and selling of financial instruments, such as stocks, forex pairs, or cryptocurrencies, Bank-Nifty, Nifty-50 to capitalize on small price movements. Scalpers are not concerned with long-term trends; instead, they focus on exploiting short-lived opportunities.

Key Elements of Scalping Trading Strategy:

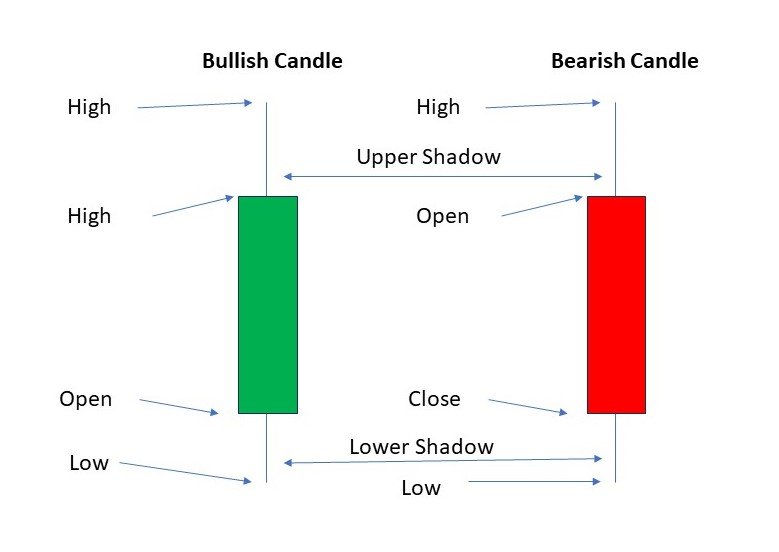

- Precise Entry and Exit Points: Scalpers rely on technical analysis to identify optimal entry and exit points. This often involves utilizing indicators like moving averages, stochastic oscillators, and support/resistance levels.

- Risk Management: Given the high-frequency nature of scalping, effective risk management is crucial. Scalpers employ tight stop-loss orders to limit potential losses.

- Liquidity and Volatility: Scalpers prefer markets with high liquidity and volatility, as these conditions facilitate rapid execution of trades.

- Timeframes: Scalping is typically performed on short timeframes, ranging from seconds to minutes, allowing traders to take advantage of immediate market movements.

Benefits of Scalping:

- Quick Profits: Scalping can yield rapid profits, making it an appealing strategy for traders seeking immediate returns.

- Reduced Exposure: Scalpers are exposed to market risk for a shorter duration compared to other trading styles.

- Adaptability: Scalping can be applied to various asset classes, providing flexibility for traders.

- Minimal Overnight Risk: Scalpers do not hold positions overnight, reducing exposure to overnight market fluctuations.

Risks and Challenges of Scalping

While scalping offers the potential for quick gains, it is not without its risks. Market volatility, slippage, and execution speed are crucial factors that can impact scalping success. Additionally, psychological discipline is paramount, as the fast-paced nature of scalping can lead to impulsive decisions.

Scalping vs. Other Trading Strategies

It’s essential to understand how scalping differs from other trading styles, such as day trading or swing trading. Each approach has its own set of characteristics and timeframes, catering to different risk appetites and trading preferences.

Best Practices for Scalping

To excel in scalping, traders should adhere to certain best practices:

- Stay Informed: Keep a close eye on financial news and events that can influence market movements.

- Practice Discipline: Stick to your predefined trading plan and avoid impulsive decisions.

- Continuous Learning: Stay updated with the latest trading strategies and techniques.

- Regular Evaluation: Analyze your trades to identify areas for improvement.

Choosing the Right Market for Scalping

Certain markets are more conducive to scalping due to higher liquidity and volatility. Forex markets, major stock indices (Nifty50 or Bank-Nifty that’s the Indian index), and cryptocurrencies are popular choices for scalpers.

Common Mistakes to Avoid in Scalping

- Overtrading: Resist the temptation to execute too many trades in a short period.

- Ignoring Risk Management: Neglecting proper risk management practices can lead to significant losses.

- Neglecting Market Conditions: Failing to consider overall market trends and conditions can be detrimental.

Conclusion

Mastering the scalping trading strategy requires practice, discipline, and a thorough understanding of market dynamics. As a scalper, precision, and speed are your allies. By carefully honing your skills and adhering to a well-defined strategy, you can unlock the potential for consistent profits in the fast-paced world of scalping.

FAQs

- Is scalping suitable for beginners in trading?

Scalping is a high-speed strategy that requires advanced knowledge of trading. It is recommended for experienced traders who are comfortable with rapid decision-making. - What is the optimal timeframe for scalping?

Scalping is typically performed on short timeframes, such as seconds to minutes, to capitalize on immediate price movements. - How can I manage risk while scalping?

Effective risk management in scalping involves setting tight stop-loss orders and limiting the size of each trade. - Which markets are best for scalping?

Markets with high liquidity and volatility, such as forex, major stock indices, and cryptocurrencies, are conducive to scalping. - What are the main challenges of scalping?

The main challenges in scalping include market volatility, slippage, and the need for rapid execution, as well as the psychological discipline required to make quick decisions.