Introduction

If you understanding the intricacies of the Doji candlestick pattern can certainly be the key to unlocking profitable opportunities in the fast-paced world of stock trading. Doji candle holds a special place among these patterns. Its unique structure and interpretation can provide valuable insight into market sentiment. In this comprehensive guide, we will delve deeper into the world of Doji candles, and provide you with the knowledge you need to make informed trading decisions.

Table of Contents

4-Doji Candles and His Nature:

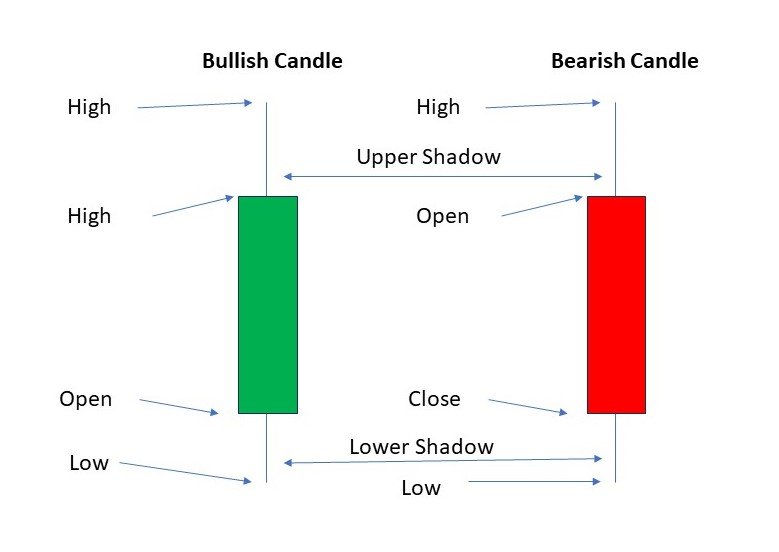

- A Doji candle is a single candlestick pattern.

- Characterized by its open and close being very close to each other.

- Often the open and close prices are at approximately the same price level.

- Doji candle results in a thin line.

- Doji resembles a cross or a plus sign.

- Body is almost non-existent meaning the length of shadow or light can vary, but the defining feature is the almost non-existent body.

The Psychology Behind the Doji

Understanding the psychology behind Doji candles is important for any trader. It represents a market in equilibrium.

- Perfectly depicts the tug-of-war between buyers and sellers.

- When a Doji forms after a strong uptrend or downtrend, it signals indecision and a possible reversal.

- Traders look for confirmation from subsequent candles to make informed decisions.

Types of Doji Candles

There are several variations of the Doji candle, each with its own implications:

1. Standard Doji

A standard Doji occurs when the opening and closing prices are virtually identical. It signifies a standoff between buyers and sellers.

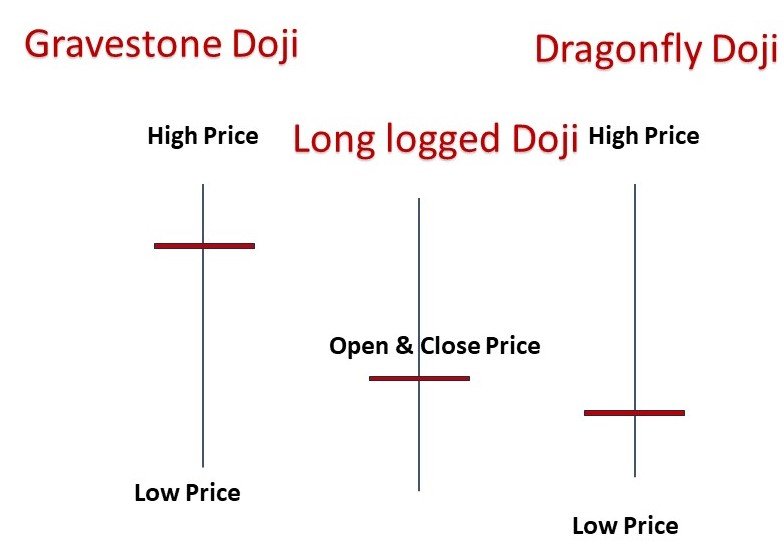

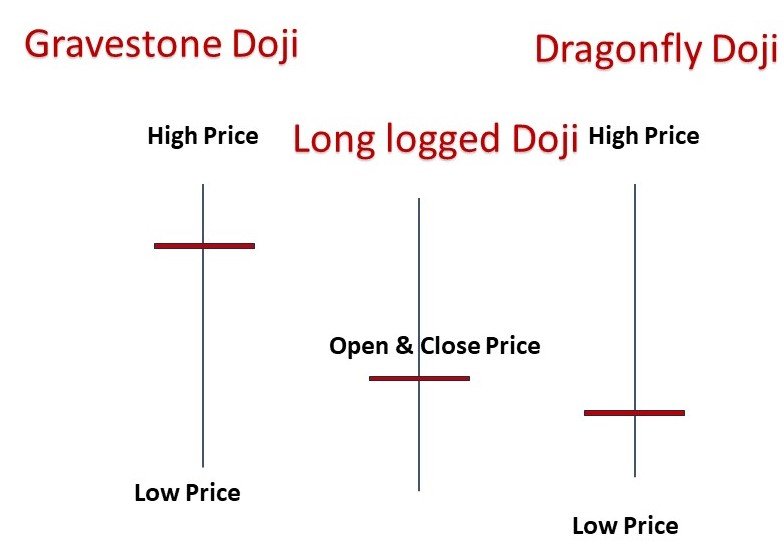

2. Long-Legged Doji

This variation has long upper and lower shadows, indicating heightened volatility and even greater uncertainty in the market.

3. Dragonfly Doji

Characterized by a long lower shadow and a non-existent upper shadow, the Dragonfly Doji suggests a potential bullish reversal.

4. Gravestone Doji

Conversely, the Gravestone Doji boasts a long upper shadow and no lower shadow, hinting at a possible bearish reversal.

Incorporating Doji Candles into Your Trading Strategy

To effectively use Doji candles in your trading strategy, consider the following steps:

1. Identify Doji Patterns

Scan your charts for Doji formations, especially after prolonged trends. These can serve as potential turning points.

2. Confirm with Volume and Other Indicators

Validate Doji signals with volume indicators and complementary technical analysis tools for added assurance.

3. Set Clear Stop-Loss and Take-Profit Levels

Establishing these levels will help you manage risk and secure profits in volatile markets.

Comparison of the four main types of Doji candles:

| Type of Doji Candle | Description | Significance |

|---|---|---|

| Standard Doji | # Opening and closing prices are virtually equal. # Small to no real body, representing indecision between buyers and sellers. | Indicates market indecision and potential trends may be reversal. Often seen at the end of a trend. |

| Long-Legged Doji | # Long upper and lower shadows, with a small or non-existent real body. # Signifies even greater uncertainty and indecision than a standard Doji. | Suggests a major battle between buyers and sellers, potential trend reversal or consolidation. |

| Dragonfly Doji | # No lower shadow, only an upper shadow. # Opening and closing prices are at or near the high of the day. | Indicates strong buying pressure and potential bullish reversal. Often seen at the end of a downtrend. |

| Gravestone Doji | # No upper shadow, only a lower shadow. # Opening and closing prices are at or near the low of the day. | Signals strong selling pressure and potential bearish reversal. Often seen at the end of an uptrend. |

Understanding these different types of Doji candles can provide valuable insights into market sentiment and potential trend changes, helping traders make informed decisions.

You Must also read about the PE Ratio to decode the market direction

Conclusion: Mastering Doji Candles for Profitable Trading

In conclusion, Doji candles are a powerful tool in a trader’s arsenal. Their ability to reveal market indecision and potential reversals can greatly enhance your trading strategy. Mind you, successful trading is not just about predicting the future, but also about managing risk and making informed decisions. By incorporating Doji candles into your analysis, you gain a valuable edge in the dynamic world of the stock market. Start honing your skills today and watch your profits soar. Happy trading!

Doji how do work in a bearish market?

This gives a reversal or bearish signal to traders/investors. These opening and closing points are almost identical, indicating that the market is preparing to reverse or a consolidation period has begun. Buyers and sellers are confused about which market is going in which direction.